FICO 9 – What’s Different? Medical Collections The big change is how FICO 9 treats unpaid medical bills. The FICO 9 formula treats medical bills sent to collections differently than other debts. These debts won’t ding your credit as much as non-medical debts sent to collection. The change follows studies by the Consumer Finance Protection Bureau (here’s one). This change is sensible. Medical debt is often for things outside of our control. Consumers may overspend on vacations and electronics, but they are less likely to be addicted to emergency room visits. As explained by Fair Isaac earlier this year: FICO® Score 9 differentiates unpaid medical accounts in collections from unpaid non-medical accounts in collections. FICO’s research found that unpaid medical accounts were less indicative of credit risk than unpaid non-medical accounts. In fact, building the most predictive credit score requires treating medical collections this way. Paid Collections A second significant change with FICO 9 is the score’s treatment of paid collections. When a debt is sent to collections, it understandably hurts a consumer’s credit score. The new credit score formula, however, disregards any collection matters that the consumer has paid in full. Rent Payments May Count A final big change deals with rent payments. Under FICO 9, rental payment history is factored into the score when a landlord reports the payments to a credit bureau. This change can be particularly helpful to those with a limited credit history. Read the full article on Forbes.com How to Get Your FICO 9 Credit Score You can find a list of the different ways to get access to your credit scores here.

3 Comments

The mortgage delinquency rate in Central Florida also decreased in June. The rate of mortgage loans 90 days or more delinquent was 4.49 percent, down from 6.01 percent last year.

Statewide, Florida’s foreclosure rate was higher than metro Orlando’s, at 1.77 percent in June, down from 2.83 percent for the year-ago period. The mortgage delinquency rate in the Sunshine State was 4.79 percent in June, down from 6.33 percent in June 2015. Decreasing foreclosure rates signals a positive trend in Orlando's real estate market because they indicate a stronger homeowner market and help boost property values. Read the full article at bizjournals.com IKEA Catalog Time is always a joyful time. Affordable, stylish, practical furniture fills its pages—nary a $2,000 pendant light in sight. The 2017 catalog is no exception. Behold, our 10 favorite pieces from Swedish heaven.

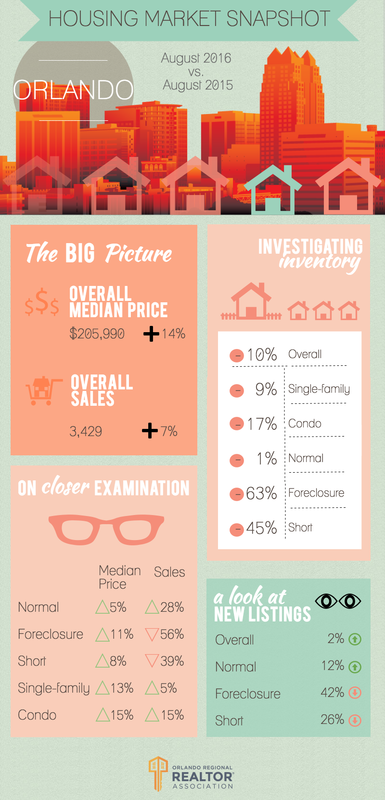

Read the full article at the washingtonian.com Orlando home sales jump 7 percent; median price rises 14 percent as inventory continues downward slide.

|

RSS Feed

RSS Feed